The beautiful city of Davos, Switzerland is host to the annual World Economic Forum. Photo by Chris Ratcliffe/Bloomberg.

This week, January 23-27, leaders in business, politics, academics, and other areas of society from around the world are gathering for a meeting in Davos, Switzerland. Their goal is to improve the overall state of the world through collaborative discussions focusing mostly on the economy. The annual World Economic Forum (WEF) is a unique opportunity for world leaders to take a sweeping view of how the economies of various countries affect and interact with each other, and thus impact the overall state of the world economy. Many prominent Americans, including athletes such as Derek Jeter, actors such as Charlize Theron, and bank CEO’s such as JP Morgan CEO Jamie Dimon are in attendance.

Photo by Telegraph, UK.

As you know from reading Kitchen Table News (KTN) over the past few months, the U.S. economy is not in a healthy state. The National Debt is at roughly $16.4 trillion and rising. The unemployment rate is hovering close to 8.0%. Growing a business, especially a small business, is difficult under the current taxation laws. Banks have been in a precarious position since the economic downturn of 2008. Profitable investing is difficult, since banks are reluctant to offer interest on investments, and so many banks have gone completely out of business that people don’t want to trust them with their money.

Cartoon courtesy “The Independent”.

The National Debt to GDP ratio is another sign of the weak U.S. economy, with this ratio having recently eclipsed the 100% mark in the U.S. As you know from reading KTN, the National Debt is the amount of money a government has borrowed but not yet paid back to keep the country running. The GDP is the Gross Domestic Product – the dollar amount of product produced in that country that can be sold domestically or exported for sale, and also the dollar amount that companies spend to do business in that country. You can imagine that when a country owes more money than it is worth, that is very bad for the economy.

This chart shows how the increase in national debt has continued to increase the Debt to GDP ratio in the United States. A lower debt to GDP ratio is the sign of a healthy economy, while a higher ratio indicates a weakening economy. Graph reprinted from http://theonethingilearnedtoday.wordpress.com/2011/09/05/whitherusdebt/

Since many items such as cars and clothing can be built less expensively in other countries, many companies “outsource” their production – building that item in a country where labor is cheaper, for example China. Although you may have purchased a shirt from Old Navy, this item is not considered part of the GDP if it was made in China and then imported back into the U.S. so you can buy it at the mall.

The next time you buy a T shirt at the mall, check the label to see in what country it was made.

The U.S. economy is not the only one in trouble. Five countries in Europe have recently suffered severe economic instability: Portugal, Italy, Ireland, Greece, and Spain. The plight of these five countries is so similar that together they were awarded the acronym “PIIGS”. During the recession that affected the U.S. in 2008, the economies of these five countries were profoundly weakened. Greece especially appeared poised to default on its national debt.

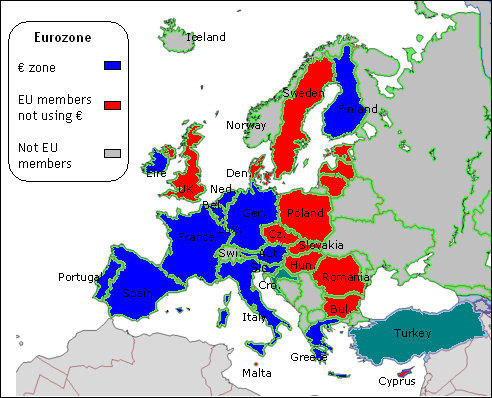

Part of the concern over the failing economies of these five countries is that they are all tied to the European Union – a union of all of the major countries in Western Europe that share the same currency, the Euro. In order to prevent a shock wave through the rest of the European Union, European leaders were essentially forced to bail these countries out. On May 10, 2010, the ECB (European Central Bank) and the IMF (International Monetary Fund) approved a 750 billion euro bailout package for these countries.

Cartoon depicting how the five European nations who have the acronym “PIIGS” are taking advantage of the other countries who share the Euro as currency. Cartoon from brazilanbubble.com.

But since then, the economies of these countries have continued to weaken, with soaring national debt and rising unemployment rates. Dissolving the EU has even been discussed to prevent these countries from destabilizing the rest of Europe who uses the Euro as its currency.

This map depicts the countries that are part of the Euro Zone.

And so, meetings like the World Economic Forum are more important than ever before, as the best and brightest leaders in the world come together to share information, discuss ideas, and gain a greater understanding of how economic decisions made domestically will impact the global economy. The United States is still regarded as the world’s #1 superpower. But if the U.S. cannot find a solution to its own economic woes, then the impact on the global economy cannot be underestimated.

Climate change has been a hot topic for discussion, both in the Obama administration and in Davos. photo from http://video.foxbusiness.com/v/2114304785001/

Click here to take a short quiz to see how much you learned.